There are certain works – literature, academic papers, experiences that are foundational to our mental models. The Five Stages of Small Business Growth might be the keystone of my mental model and core to how we approach engagements across our business. When we discuss benchmarking, as many consultants and investors do, we are categorizing against this paper.

In this series, I’ll break down parts of the short paper, how we think about them, and how you can use this short paper to guide your strategy and tactics as an operator.

In this inaugural piece I’ll unpack the first two exhibits and the fallacies in most business thinking, especially relevant to founders who don’t want to ride the VC train or grow and exit a business.

First, when considering a business’s maturity simple size and age do not suffice. Some businesses involve tremendous up front IP production, some require large numbers of locations, some are capital intensive or human capital intensive, and some add more value than others.

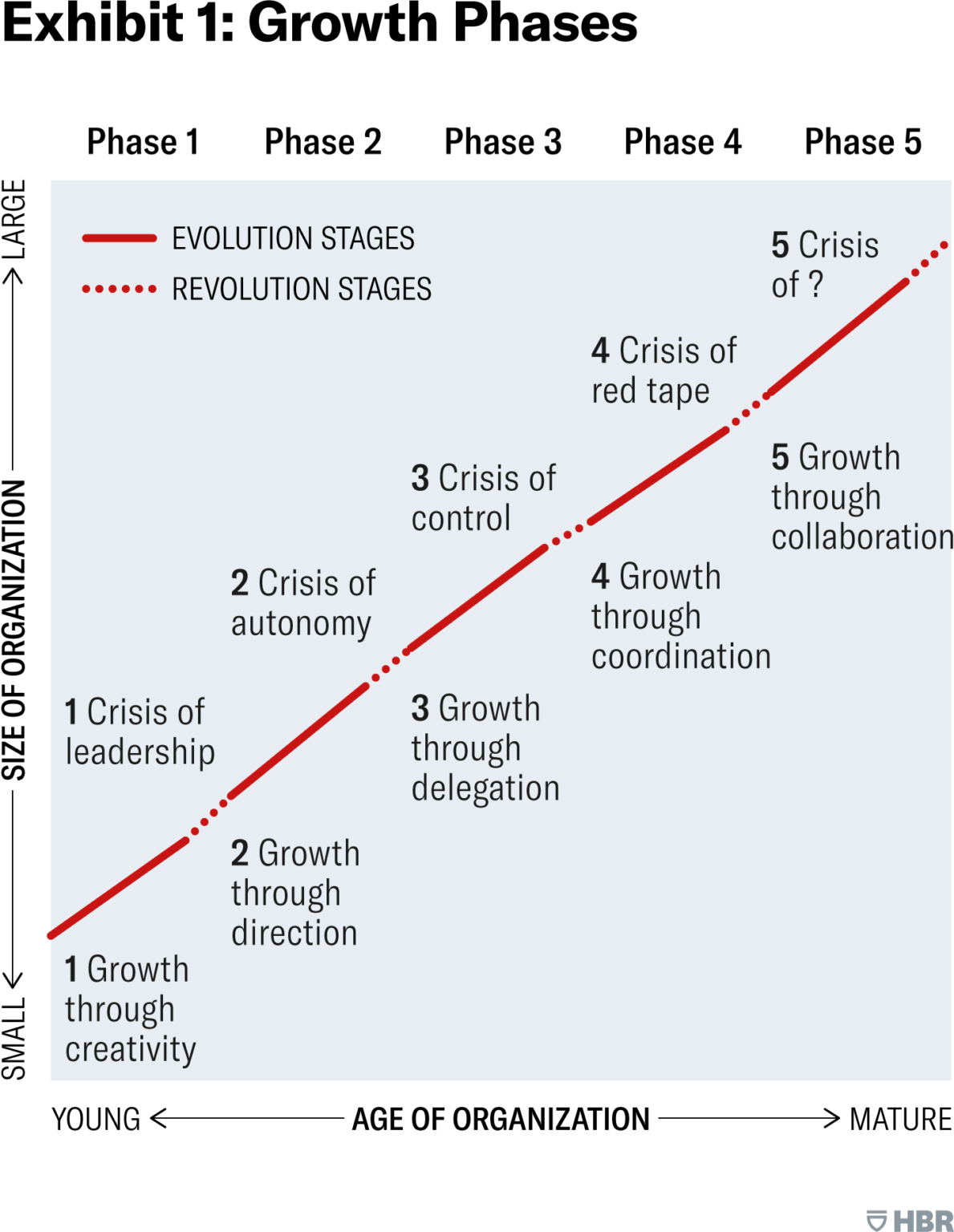

When we inspect Exhibit 1’s growth phases we see the standard of business lifecycle growth plotted linearly. We see the purported growth factors – creativity, direction, delegation, coordination, and collaboration. We can observe where the inflection points of companies manifest in crises of – leadership, autonomy, control, red tape, and financial engineering (Joe’s creative license to replace ? in the actual exhibit for those comparing in real time). It goes without saying that some businesses are largely flat in terms of size (sales or headcount) and rapidly scale into a delegation phase as they scale up rapidly. This graph simply does not capture the nuance of growing a business and would indicate a basis for consideration in legacy mature enterprises.

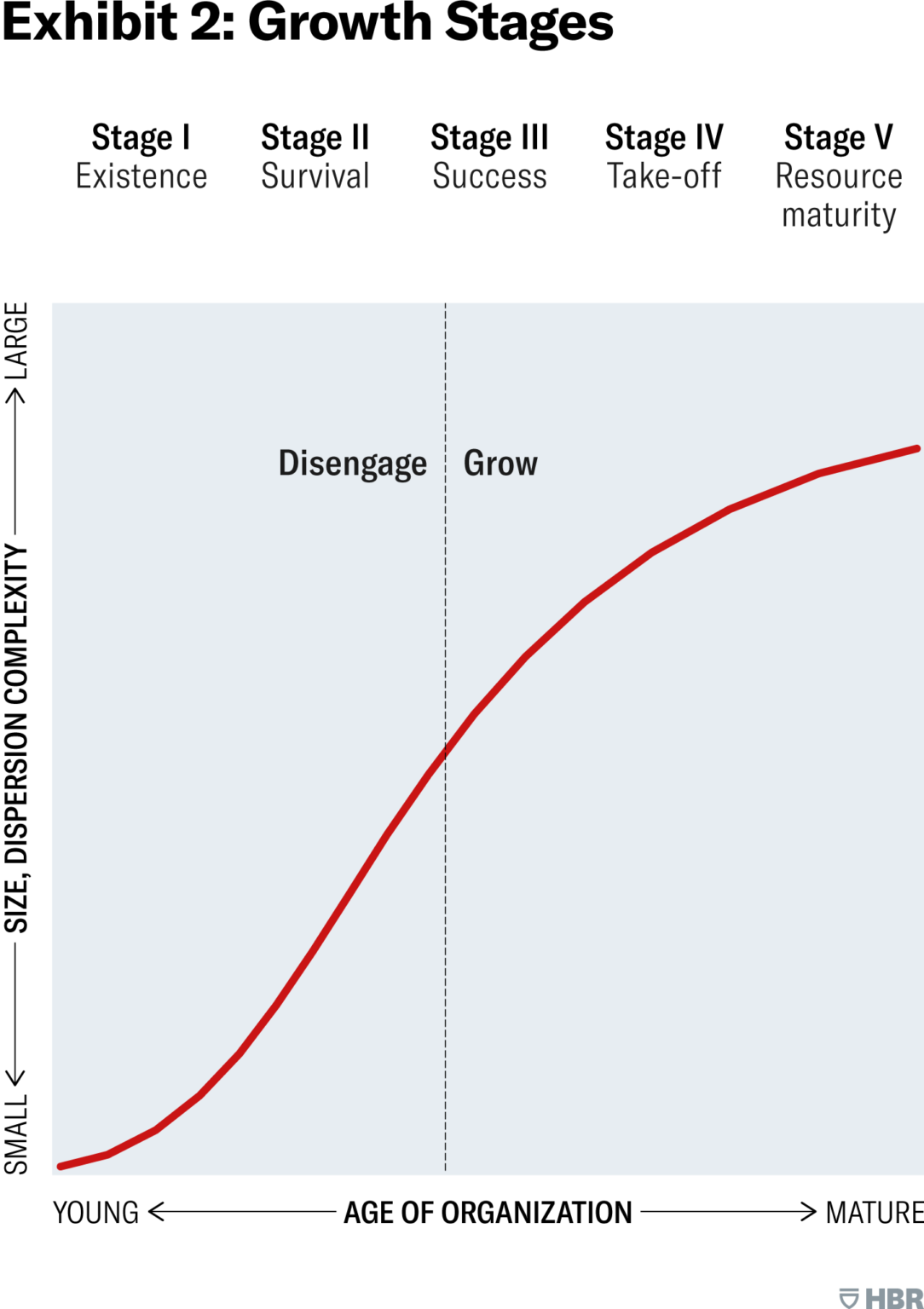

Exhibit 2, particularly the stages and the dotted line of disengagement versus grow rings truer to us. Young companies, by necessity, must not be large, diverse, or complex. We often cite the one product, one channel until you master it approach to building a business. In fact, it’s quite possible to build a business entirely to the disengagement point on a single product and single channel with one strategic level (i.e. – ecommerce drop-shipping businesses built on sophisticated placement and SEO optimization). This is the key graph for us when considering what parts of the Cross/Section Operating System to deploy for our clients and when brainstorming all the strategic levers of an investable asset on our capital side. We have yet to find a company that is acting entirely inside the stage they’re in, though our friends at the AI Services company in the testimonials page did a very good job. The names tied to the stage are visceral – at each stage managers struggle through the word and aspire for the next. This same thread pulls through more recent works such as Blitzscaling by Yeh and Hoffman, the slope of the line is what changes between a lifestyle company and disengaged owner of a successful business to a company seeking to massively scale ahead of a zero sum emerging market.

Though these two graphs represent a fraction of the content in the article, it’s quite easy to ruminate on them until your head hurts. I urge you who have read this far to read just through “Stage I: Existence” and be honest with yourself on if your business or product line or small piece of a large enterprise has truly exited this stage. What more could you do to ensure your project continues to exist?